GrozServices Business-News

GrozServices Business-News

Foreign Direct Investment (FDI) Rebound

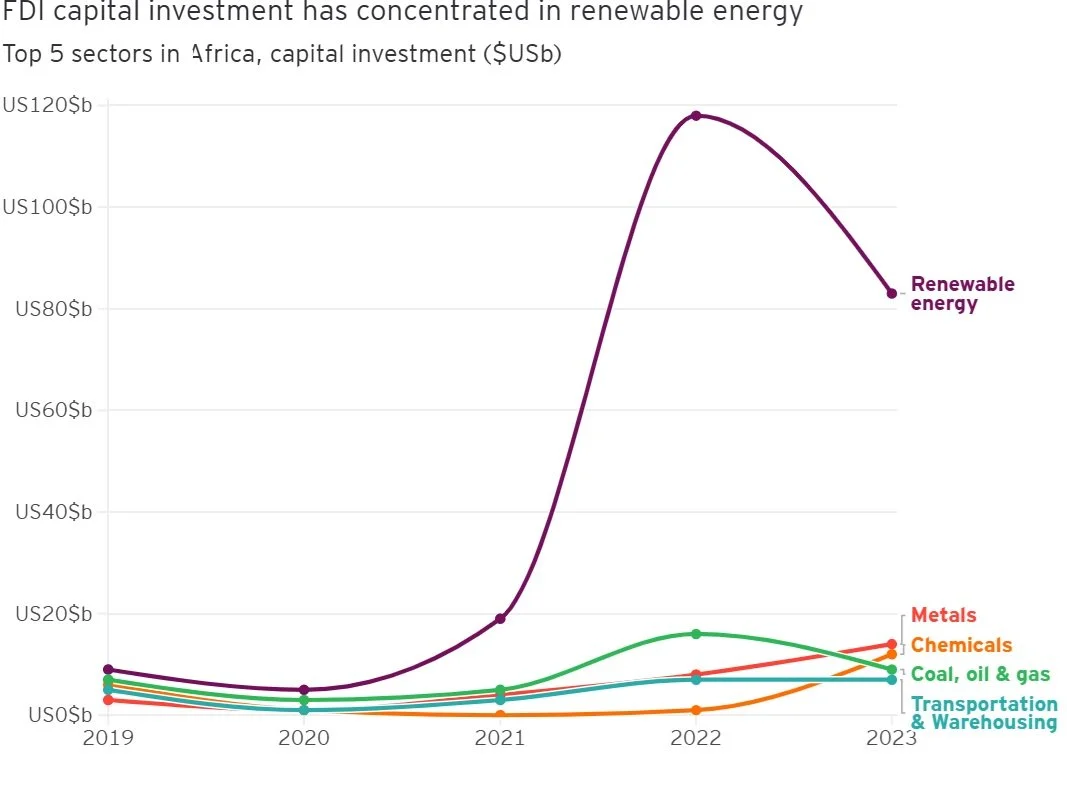

South Africa still dominates the region, despite its slow growth In 2022, Southern Africa attracted the second-highest number of investment projects (207, +47%), with capital investment of US$36b, creating25,000 jobs. Almost 75% of the southern region’s FDI (measured by projects) went to South Africa. Investment into the rest of the region struggled as it grappled with soaring commodity prices, food insecurity, debt distress, climate shocks, poor infrastructure and water scarcity. While South Africa’s growth outlook is tepid, the country’s energy crisis also brings opportunities for investors. This can be evidenced by it being the third-largest recipient of CleanTech FDI into Africa, trailing only Egypt and Morocco. Evidence suggests that solar rooftop photovoltaic (PV) rose from 983MW in March 2022 to 4,412MW by June 2023. As the energy crisis continues, the shift from the national grid escalates the need for alternatives.

Foreign direct investment in Africa is being shaped by sustainability, economic diversification and financial inclusion.

The continent’s commitment to renewable energy not only positions it as a key player in the transition to sustainable, low-carbon economies but also highlights the critical role of these investments in bridging the electricity access gap. "With its abundant renewable resources, the continent offers environmentally conscious investors a unique strategic advantage while addressing the urgent need for widespread electricity access." says Sandile Hlophe, EY Africa Government and Infrastructure Leader.

Source: EY Africa Attractiveness Report 2023